Inception: 1 Sep 2024

Return since Inception: 17.62%

S&P 500 Return (same period): 5.33%

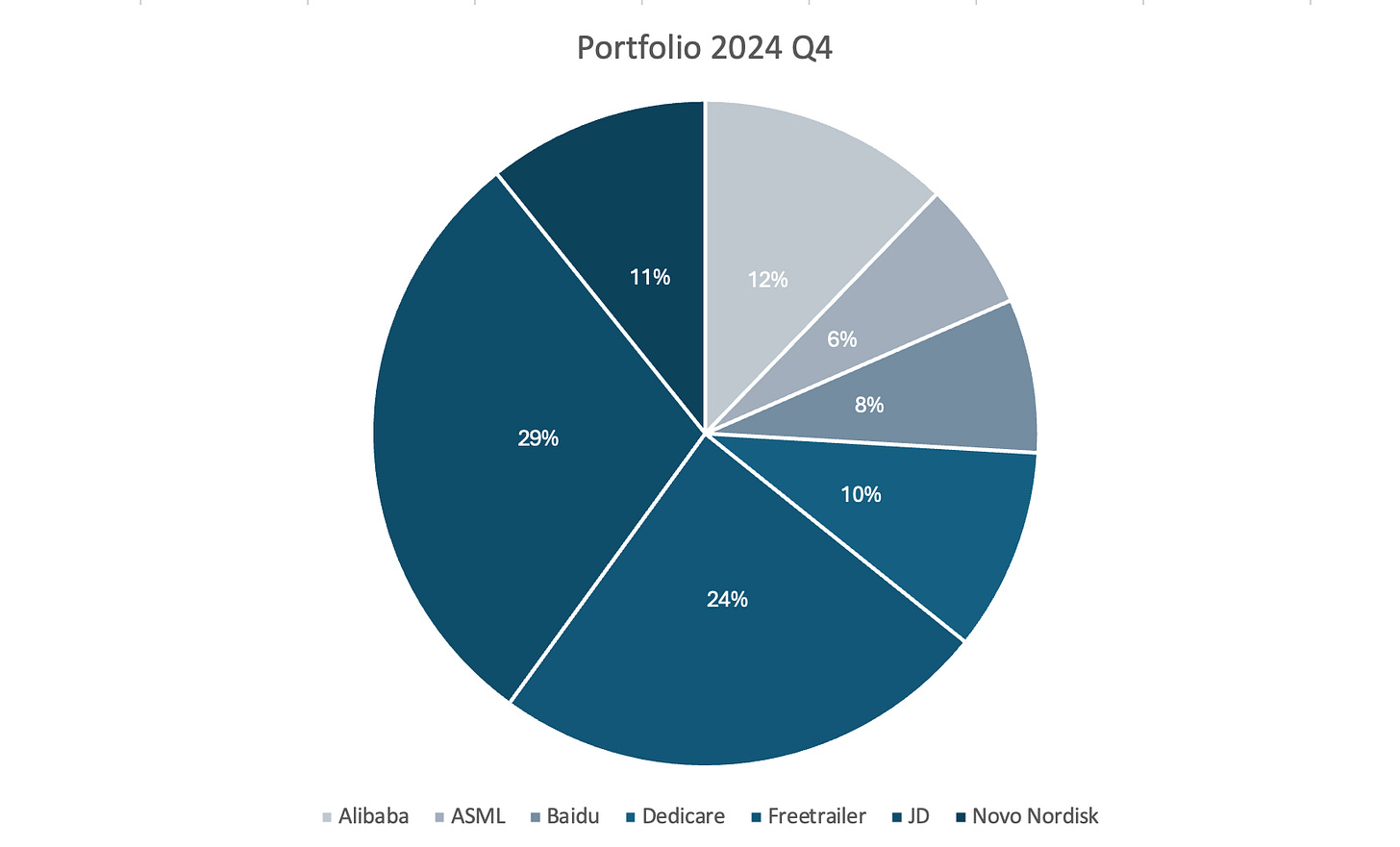

Buy Prices:

🇨🇳JD: $26.32 (+40.78%)

🇩🇰Freetrailer: 45.53DKK (+18.79%)

🇨🇳Alibaba: $73 (+16.62%)

🇨🇳Baidu: $85.11 (+1.92%)

🇳🇱ASML: €683.80 (+0.10%)

🇩🇰Novo Nordisk: 589.20DKK (+0.09%)

🇸🇪Dedicare: 66.76SEK (-17.17%)

Comment:

The portfolio has performed well over the past three months. While this is a positive start, short-term results don’t mean much. Markets often move based on sentiment rather than substance in the short term. Over time, however, they reflect the true value of businesses. My focus is always on the long term.

My strategy is simple. I invest in strong businesses at reasonable prices. I avoid speculation and stick to fundamentals. Before I invest, I study a business closely. I want to understand how it operates, how it generates profits, and what it is worth. When I find a gap between price and value, and the margin of safety is large enough, I act. I will be wrong, and I will be wrong often. The question is how much I lose when I’m wrong. What matters is limiting losses when I’m wrong and allowing gains to compound when I’m right.

The portfolio has a large exposure to Chinese companies. Chinese stocks today offer some of the best value in the market. Many of these companies have strong fundamentals, but their share prices don’t reflect their full potential. I believe this creates a rare opportunity. Novo Nordisk dropped -20% today and I saw that as a fantastic opportunity to buy a few shares, I will publish an analysis the upcoming week. Dedicare is still showing signs of weakness but in the long-term I believe there’s a 100% upside which will likely be realised within 3 years.

I will publish quarterly portfolio updates from now on so make sure to subscribe, it’s free.

I hope you had an amazing 2024 and an even better 2025, Merry Christmas!