Investment Thesis: Freetrailer (FREETR)

An easy-to-run business with great management, understandable business model and predictable cash flows.

1.0 Introduction

1.1 Business overview

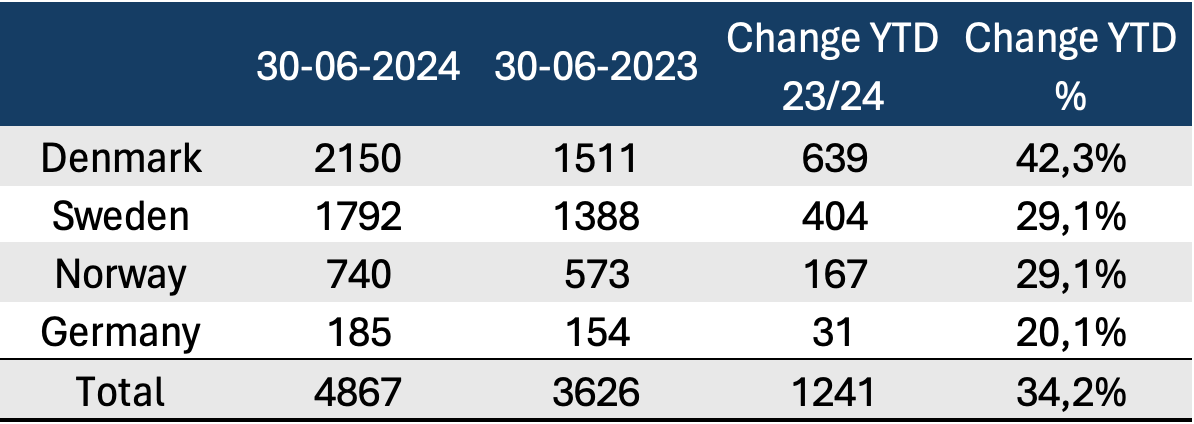

Freetrailer is a 20-year-old self-funded company that is disrupting the trailer rental industry with a sharing economy platform, making it four times cheaper to rent a trailer compared to conventional methods. As of 30 June 2024, Freetrailer had 1,229 locations in Denmark, Sweden, Norway, and Germany, distributed across 151 partners with a total of 4,867 rental units. This marks a significant increase of 1,241 units over the past 12 months.

They hold a 60% market share in Denmark and are growing quickly in Sweden and Norway. The company have stable and high margins, low capital expenditure, strong cash flow, and a healthy balance sheet with almost no debt. They have excellent management, who together own the majority of the company. Revenue is rising much faster than costs, which likely will increase their gross and net margins in the long-term. I believe the market is underestimating Freetrailer’s growth potential and the network effect on their platform, and therefore, I’m adding the company to my portfolio. Updates will be published quarterly.

1.2 Investment Case

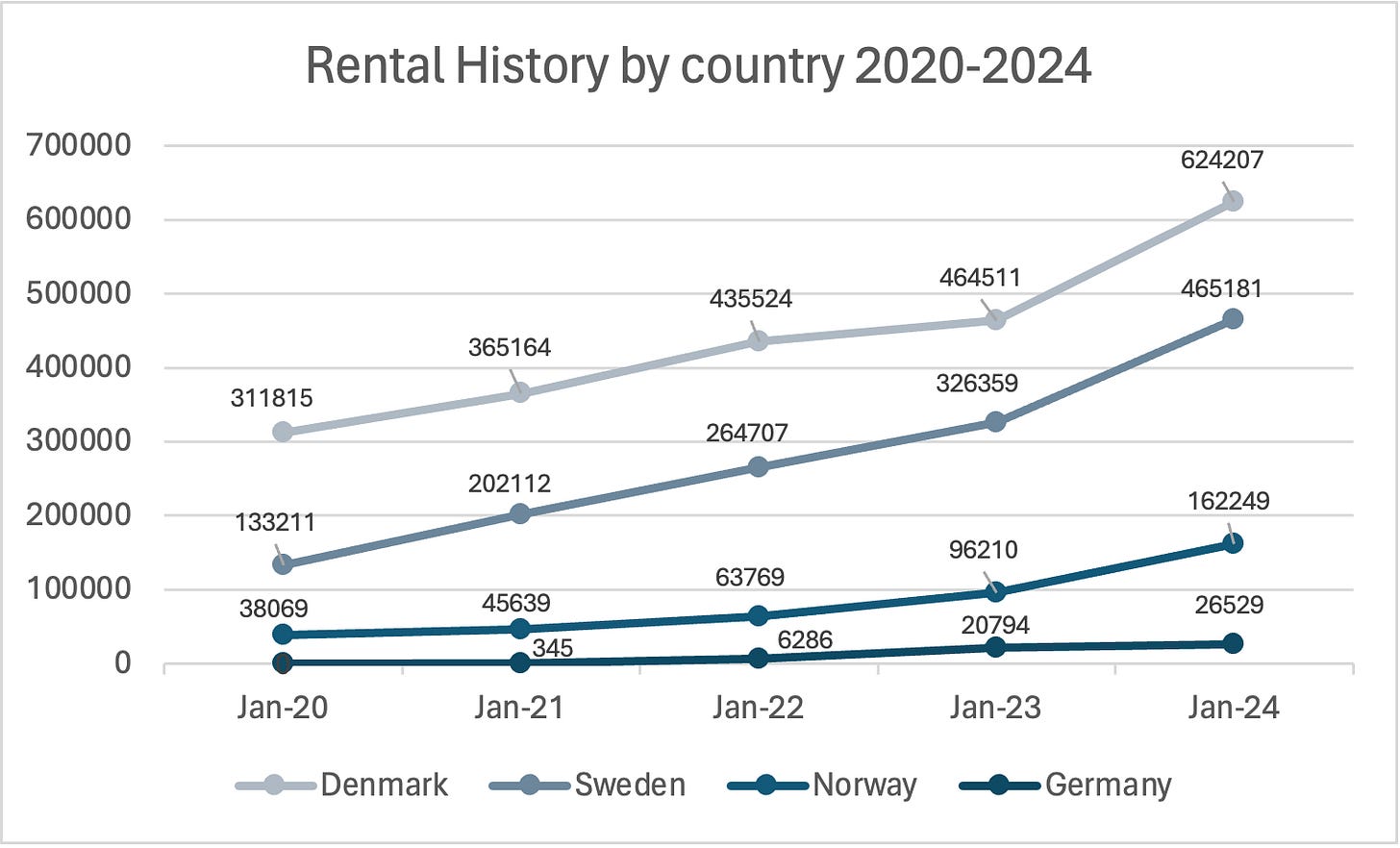

Near-Monopoly Market Position in Scandinavia: They are the first company in Europe and possibly the world that is operating a sharing economy model for trailers which on average makes their rentals four times cheaper for the consumer renting trailers the conventional way. They have a 60% market share in Denmark with 625 000 rentals for the last 12 month as of June 31 2024. In total 465 000 rentals in Sweden and 162 000 in Norway. Germany is a much less mature market and they are not as established there as they have in Scandinavia, in total they had 26 000 rentals in Germany. Their rentals have grown every year in every region from 2020.

A Win-win solution: Customers can rent a trailer for free, which makes for an excellent customer experience. On average, renting a trailer from Freetrailer is four times cheaper than traditional rental methods. It’s also far more convenient, with trailers available at 1,229 locations through 151 partner sites—right where customers need a trailer. Partners benefit as well, gaining an affordable and convenient logistics solution for their customers and free advertising as the branded trailers drive around town. On Average, 32% visit the store after renting or leaving a trailer which creates amazing value for both partners and customers. The average customer basket size is 350 EURO (Survey conducted in Q1 2024. 12.588 responses). Freetrailer have a rating of 4.8/5 on trustpilot out of over 11 000 reviews.

Capital light: Freetrailer have a healthy balance sheet with substantial cash reserves, almost no debt, low depreciation and interest expenses, and low capital expenditures. This creates opportunity to invest most of their distributable earnings into new investments that can drive growth and profitability. Freetrailer’s ROIC is 45% compared to a WACC of 8%. Management will not issue any dividends if they believe they can use the cash somewhere else and generate a higher return which they expect to do far into the future.

It’s boring: When I excitingly told my friend about a new company I found renting out trailers, he laughed a little and said, yeah but they are renting trailers, that’s not very interesting. I agree, but I would rather invest in something I fully understand and will drive profitability and growth than something interesting and exciting I’m unable to fully grasp, at the end of the day it’s the digits on the bottom line that counts.

1.3 How it works

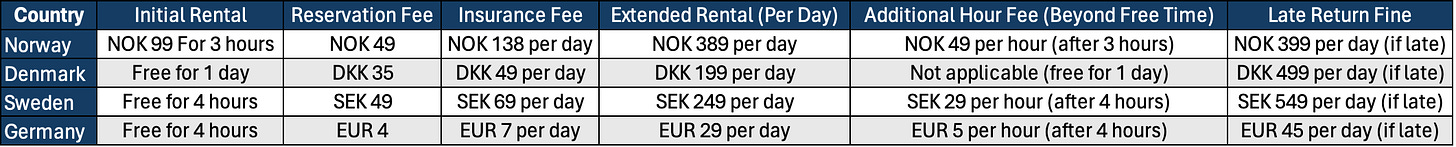

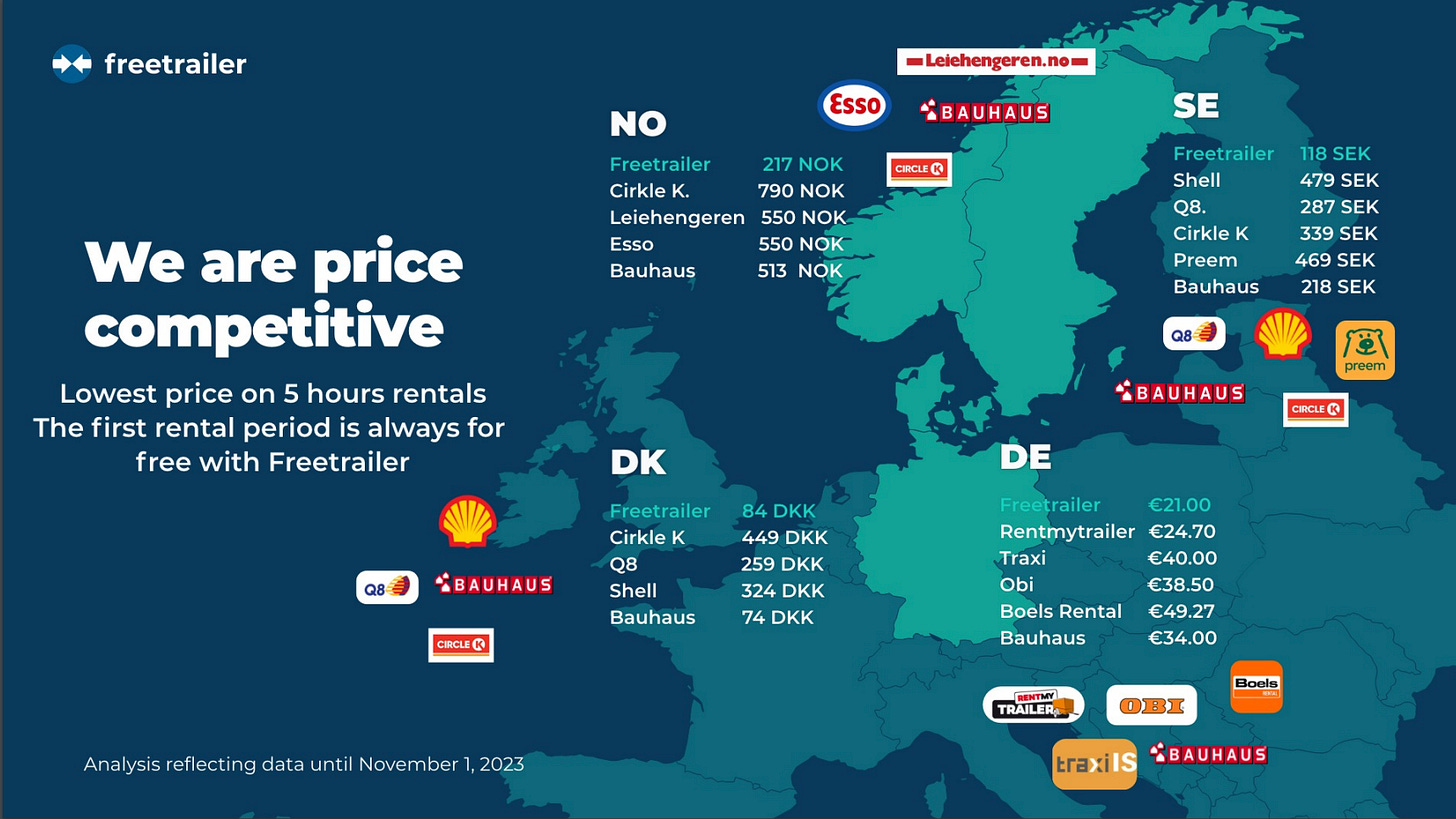

Download the Freetrailer app, and once open, you’ll see a map marking all available trailers. Select the trailer you want to rent, usually located near popular partner locations like IKEA, JYSK, and ICA. Reserve it for any available time that suits you. To pick it up, simply go to the chosen location and unlock the trailer using the app’s Freelock feature. After using the trailer, return it to any Freetrailer location to complete your rental. In the table below you will see pricing per country.

2.0 Business Model

Freetrailers doesn't purchase its trailers and bikes; instead, they lease them from the Danish company Variant for 3-5 years and then flips it for a profit. This approach reduces the need for large capital outlays, as well as depreciation and capital expenditure costs creating a fairly capital light business model. The primary component of their Cost of Goods Sold is the leasing expense for these trailers. This strategy enables them to maintain significant operational leverage and decreases the risk.

Revenue: Over 80% of their revenue come from insurance, reservation and extending the borrowing time. The rest comes from partners for providing them with branded trailers and full maintenance. The revenue per trailer per day is approximately 60 DKK (106M DKK in total year end 23/24).

Cost of Goods Sold (COGS): Leasing is the primary COGS, estimated at around 22 DKK per day per unit (7990 DKK a year per trailer) and 39M DKK for the year. COGS also consist of external cost which mostly consist of fixed expenses of around 13M DKK.

Other expenses: Staff expense of 32M DKK which is expected to increase slower than revenue because they can increase their units available for rent without increasing staff. Depreciation and interest expense is very small because they don’t have either debt or many tangible assets that depreciate over time. The tax rate is 24%.

Net Margin: Freetrailer can double their capacity (trailers and bikes) without the need of hiring new staff which will further keep cost down. This will basically double the revenue while keeping both OPEX, CAPEX and Depreciation expense at relatively the same level which will increase the net margin and create leverage on the net profit. There will likely be an increase in expenses as more people use their service, more bugs and problems may occur which will require more IT-staff and service agents to be able to keep a seamless customer experience. However, this cost increase will be marginal and not close to their revenue growth. This business model shows scalability because net margin will increase substantially from these levels as revenue increases.

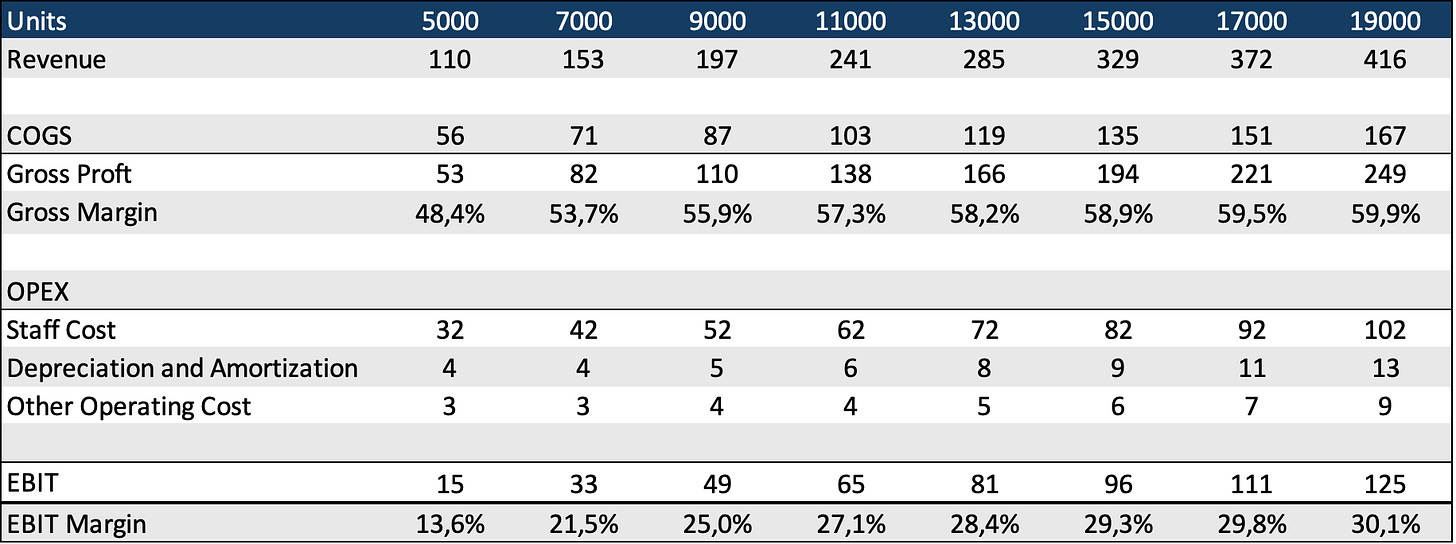

It’s impossible to forecast their exact expenses and revenue per unit in the future, but the table below provides insight into how their business model works and how margins expand as revenue increases. I have made the following assumptions: i) Fixed costs are 15M DKK and leasing cost per trailer is 7990 DKK per year, ii) revenue per unit stays at 21,900 DKK per unit, iii) staff costs increase by 10M DKK every year, and iv) D&A and other operating costs increase by 20% annually. All numbers are in millions, except for the units.

3.0 Valuation and Expected Growth

Freetrailer Group has been growing earnings at an average annual rate of 42.5%, while the Transportation industry saw earnings growing at 27% annually. Revenues have been growing at an average rate of 21.3% per year.

I performed a reverse discounted cash flow analysis to estimate how much the company have to increase their earnings per share annually the next 10 years to justify the current valuation. The company have a market cap of 430M DKK as of 8 Nov 2024 which is 35x earnings and 16x Free Cash Flow. Based on a discount rate of 10% and a terminal growth rate of 3% after 10 years, the required EPS growth rate is around 20% per year. This calculation includes the tangible book value in the intrinsic value assessment. In other words, the market is pricing in that the company will reach a profit of around 74.3 million DKK in 10 years. (Current profit * 20% increase per year ^ years = 12*1,2^10).

Assuming a net profit margin of 20%, this would imply a revenue of 300, or three times the current level, which translates to a compound annual growth rate (CAGR) of 11.6% over the next 10 years.

It’s impossible to predict how much a company will generate in revenue 10 years from now and how high their net margin will be, but we can make educated guesses.

4.0 Key Growth Drivers

4.1 Increasing rental frequency

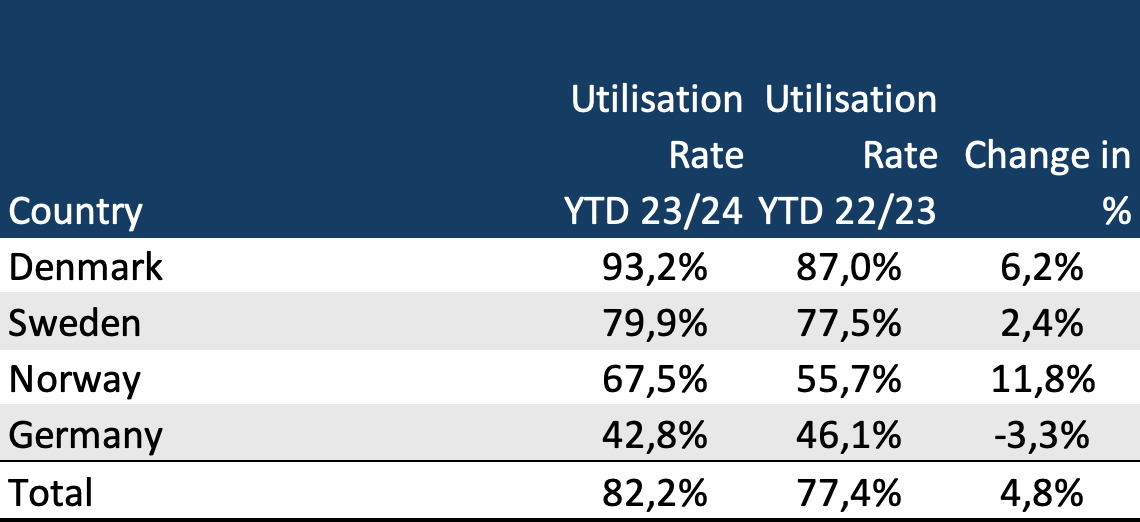

Rental frequency or utilisation rate have room for improvement in less mature markets like Sweden, Norway and Germany. As rental frequency increases revenue per unit will increase, this will not require any additional cost because the trailers that are not being used are already paid for. By increasing rental frequency, Freetrailer will increase their gross margins. The key drivers to increase rental frequency will be an increase in demand for their service. There are still a lot of people who haven’t heard about Freetrailer, but the people who have are happy customers. If you need a trailer why would you use anything but Freetrailer? It’s easier, more effective and cheaper than any other way of renting a trailer. Great products spread like a pandemic through word of mouth. The more people who know about the products, the faster the word grows (law of compounding). The company is also spending money on marketing and ads which will further drive brand awareness. I will come back to the negative growth in utilisation rate for Germany.

4.2 Increasing rental units available

Increasing rental units available will not itself drive revenue because demand must follow. However, Freetrailer have been consistent in increasing the units available for rent to without decreasing the utilisation rate (expect in Germany) which means that the demand is increasing faster than the amount of trailers available. By offering more trailers they are increasing the quality of their service by being available at more locations. The table below shows rental units available.

4.3 Expanding into new markets with key partners

Freetrailer is expanding into new markets through their established partnerships. Through IKEA, they expanded into Germany and have recently initiated a partnership with JYSK in the country. Most of their partners are large global organizations that can help Freetrailer grow internationally, which will be key to the company's success. Freetrailer has already proven that their service creates significant value for their customers and partners in Scandinavia, and by nurturing these partnerships, they have strong prospects for gaining market share in other parts of Europe together with their partners. The company plans to capture market share in the Nordics, Germany, and the Benelux countries (Belgium, Netherlands, and Luxembourg), with these regions collectively estimated to represent a market worth around DKK 1.6 billion. In the long term, the company aims to expand across the rest of Europe and eventually enter the U.S. market, though the exact timeframe for this expansion is uncertain.

4.4 Leverage on net margin

As utilisation rate increases, rentals available increases and the company grows into new markets the net margin will increase as revenue grows as mentioned before. I think this will be a key driver for building a strong cash flow that can then be used to reinvest into marketing and other reinvestments that will drive growth even further.

5.0 Competition and Market Opportunities

Freetrailer is not the cheapest option in Denmark, yet it holds a 60% market share, demonstrating that the service provides value beyond just low pricing. The convenience of picking up a trailer precisely where you need it and the simplicity of booking make it highly attractive to customers. This is a significant strength for the company because they are not only competing with pricing.

Bauhaus has partnered with a new company in the space called Use4Free, which is an exact replica of Freetrailer's business model. The company is created by Brenderup Group, a private company with a revenue of 24M SEK and a negative net profit. Since it’s private it’s unsure how successful they have been with launching Use4Free but it’s likely not taking any considerable market shares as they only have 3 partners. Visiting their website, use4free.dk, reveals a bad user experience: their app has a rating of 2 out of 5 stars from 25 reviews, compared to Freetrailer’s 5 out of 5 stars from 7,500 reviews. When I tried Use4Free’s app it was buggy, slow, and has a poor user interface, in contrasts with Freetrailer’s smooth, easy and highly rated experience.

The price to rent a trailer in Norway is much more expensive than it is in the other countries and Freetrailer can therefore price their service higher and still remain competitive in terms of price. This creates a great opportunity for growth because they will likely realise higher margins from their operations in Norway by exploiting an underdeveloped market.

Germany's growth has been slow, highlighting how difficult it is to change consumer behaviour and get people to switch from one platform to another. Even though an alternative may offer significant benefits, people can still be reluctant to change the way they rent trailers (Status quo bias). Their main competitor in terms of price is RentMyTrailer, you can read about their service and how it works here. Personally I believe Freetrailer’s service is more convenient, and as more people realise the value they provide I believe the growth will catch on. They have solid partnerships with both JYSK and IKEA and when people buy new furniture they will think about a way to transport it home and realise that there is a really easy, cost effective way to help you do just that, located just outside the store that they purchased from.

6.0 MOAT

To make a sharing economy platform for trailers successful, you need both users and partners. As more users join, the service becomes increasingly valuable to partners; and as more partners join, it becomes more valuable to users. Freetrailer holds a strong position in the Nordics, and I believe it’s nearly impossible to compete with them because Freetrailer has rock solid, already established partnerships with some of the biggest brands in the world, totaling 151 partnerships with every partnership agreement lasting between 3-5 years.

To challenge Freetrailer, a new competitor would need to offer a better service or a better deal to attract partners. However, a service in this space becomes more attractive to partners as the user base grows—meaning you would need a significant user base to win over Freetrailer’s established partners.

Currently, Freetrailer has 500,000 users which is growing, so for a competing service to be seen as a better option, it would need to exceed this user base. Yet, to attract that many users in the first place, a competitor would already need a network of well-established partnerships to drive users.

This creates a paradox: to gain partners, you need users; to gain users, you need partners. This cycle acts as a barrier, making it extremely difficult for a new entrant to achieve the scale necessary to compete effectively with Freetrailer.

But suppose you are already an established brand with a large user base that decide to go into the trailer industry. You have an app that works perfect, you have a trailer supplier. What now?

In order to get partners to switch from Freetrailer, they would have to take the risk of switching to a service that could be worse.

Freetrailer takes care of everything for their partners, including trailer maintenance, bookings, customer support, and more. Partners are only required to provide a few parking spaces and don't need to be involved in any other aspect of the service. They have 5/5 Ratings on app store out of 7,500 reviews, 4.8/5 on Trustpilot out of 12,000 reviews. Even though a company may have a larger customer base or offer cheaper prices, Freetrailer have already proven that their service works flawlessly for both their partners and customers. If you where the decision maker for IKEA, would you risk switching to a new service provider just to save a few bucks—savings so marginal and small that your manager likely wouldn't even notice them in the budget? I don’t think so.

Limitation of their moat

Freetrailer have a strong MOAT in the Nordics but if a company replicated their business model somewhere else they could win partnerships like IKEA in other countries. First-mover advantage is no joke; it’s very difficult to get people to switch from one app to another and partners to switch from one provider to another. Being second in a market can be a significant challenge. If a company with deep pockets would replicate Freetrailer’s business model somewhere else, they could partner up with Freetrailer’s partners in those countries, expand faster into new markets and slowly take over Freetrailer’s partnerships in the Nordic, however I see the latter to be unlikely because consumers are now used to Freetrailer’s app and service and that behaviour is very hard to interrupt. However, I believe it possess a certain risk in limiting the growth potential for Freetrailer in the future. On the other hand, it might also open up for mergers and acquisitions.

7.0 Reasons you might not want to invest into the stock

Peter Lynch had impressive returns on the Magellan fund, yet, the average investor lost money. A stock might go up 10x in 10 years but if you sold when the stock went down 20%, purchased again a quarter later when their earnings where a bit better and jumped in and out of the stock your returns would probably not be that impressive. I have tried to breakdown some risks regarding their operations and some considerations and reasons why you might not want to own the stock. My goal is not to sell you a stock, my goal is to share my interest about companies and try to communicate my rationale behind my investment decisions. If you are a critic and think I have became delusional, please let me know. I am open to all sorts of critics.

7.1 Low data and historical figures

Freetrailer have been publicly traded since 2018 and their earnings data is therefore a bit limited. They only quite recently started to make a profit (2020) and one could argue that 4 years of positive earnings is not enough proof to support an investment case. I think that is a reasonable argument. However, one could also argue that they have been able to build a strong enough consumer base to be able to handle their cost effectively. Their revenue have come over the threshold of covering their leasing expense, and a negative net margin would mean that revenue, or rental activity will have to decrease substantially because their costs are proportionally low.

Some more conservative investors might want to prefer the company to realize higher net margins before investing to have a bigger margin of safety and therefore only want to add this company to their watchlist. As they grow their user base the revenue will likely increase which will increase margins which makes them less and less sensitive to a drop in revenue. Maybe that’s the right move. Personally I am comfortable with my shares being worth less in the short-term as long as the story don’t change much because I believe they will be able to handle any short-term problem without any problem considering they have 33M DKK cash reserves available and almost no debt.

7.2 Competition

Freetrailer have a clear edge in Scandinavia with a strong offer and market share. This could change. Freetrailer is currently the first company in Europe and possibly the world that is operating a sharing economy for trailers right now, and it gives them a first-mover advantage over competition. However, Freetrailer have plans to expand into the rest of Europe and the US in the future and if any other company decided to replicate their business model in any of these countries before Freetrailer, it might be hard for them to take market shares in that market. They can’t simply get a patent for their business model, instead they have to be quick in expanding which will require capital. The management is conservative in taking on debt and issuing new shares and while this might make their moving pace slower, I still believe it’s the right strategy, I would rather see Freetrailer being late into the US market than over leveraged and first. Freetrailer is self-financed, and with its full expansion into Sweden and Norway, it should have enough cash to enter new markets. The more markets they capture, the greater their profits, which can then be reinvested to fuel further expansion, creating a compounding growth effect.

I believe their strong appearance in the Nordic provides us with some margin of safety. They have strong partnerships, market share and customer base in the Nordic and I believe it’s difficult for any player to compete with Freetrailer here. Nordic have capacity for around 10 000 units which will be enough to fuel expansion into new markets provided their economics stay in place.

7.3 Consumer Sentiment

Freetrailer has done a great job increasing demand for its service and building brand awareness. It’s relatively easy for them to increase the number of rentals available, but much harder to scale back. I assume that demand for Freetrailer’s service is somewhat correlated with purchases from their partners. During an economic downturn, people may spend less on purchases from companies like IKEA, JYSK, and Byggmax, which could reduce demand for Freetrailer’s service.

If consumer sentiment where to shift as a consequence of a economic downturn, this might affect Freetrailers operations negatively. If an E-Commerce company experience shorter demand they will be able to handle cost more effectively by decreasing inventory, this is not as easy for Freetrailer to do because they have leasing agreements with Variant and agreements with partners to provide them with trailers and bikes. If revenue decreases substantially this can effect their gross margin negatively.

This is where I believe Freetrailer’s management needs to think about balancing growth with resilience. If you expand too aggressively without a buffer, a sudden downturn in consumer spending could be bad in terms of profitability. On the other hand, Freetrailer have 33M DKK Cash reserves available and almost no debt, they can afford to lose money without going bankrupt.

I might be wrong in suggesting that Freetrailer’s service is directly tied to consumer sentiment and I might over exaggerate the effects of a slower economy might have; people may still need to transport items even if they’re not purchasing as many goods. For instance, during tough times, people might move to more affordable apartments and still need assistance with moving. However, I would rather to be wrong as a pessimist than right as an optimist.

7.4 Expansion into new markets might be slow and affect margins negatively

Freetrailer’s product have worked wonders in Scandinavia, but this doesn’t mean that is going to be the case for the rest of Europe. It’s very hard to change consumer behaviour and despite having a better offering than competitors, people may still choose the conventional way of renting trailers. Freetrailer have a low utilisation rate in Germany which have gone down from last year. However, this is not a consequence of people in Germany renting less, but management have increased their trailer available faster than the demand.

When the company expands into new markets it can affect the gross margin negatively in the short-term, because in the beginning, the utilisation rate will be lower, meaning less revenue per trailer. Management have been clear with they will focus on growth and taking market share in other countries before issuing dividends or improving margins in the short-term, and investors should be aware of that. It’s easy to get caught up in the numbers, while understanding them is crucial, it’s equally important to grasp the reasons behind them. I believe their offering is outstanding, and while gaining market share in new countries will be challenging, the biggest hurdle is simply building awareness. However, with strong partnerships, they benefit from organic marketing by having their trailers visibly stationed in high-traffic areas like IKEA parking lots. I’m not too concerned about awareness, as this visibility will naturally attract attention, and as more people become familiar with the product, word-of-mouth will accelerate growth.

Thank you so much for reading, I hope you enjoyed it as much as I enjoyed writing it! Read more about the company here:

Please don’t hesitate to contact me if you have any questions!

Have an amazing day :)

Best,

Philip Åström

Interesting company.

My 2 spontanous cents after reading:

They may have been able to hit jackpot in Scandinavia since the infrastructure is very similar between the countries good enough for Freetrailer to thrive in (good roads, scandinavian behaviour, store size, etc etc). But I wouldn't speculate on them being able to grow in other countries as easily unless I could prove that what they offer is better then what already exists in a country. US is much different compared to EU, so it's a different game. Idk, maybe most people either own or just know a guy who owns a trailer to borrow stuff, so barrier is a bit harder to crack? In other countries it may even be as cheap (if not cheaper) to call a company that moves stuff for you.

Just some things to consider when projecting growth, cheers